March 2021

All market data as of 17-03-2021. Sources: Company filings, S&P Capital IQ.

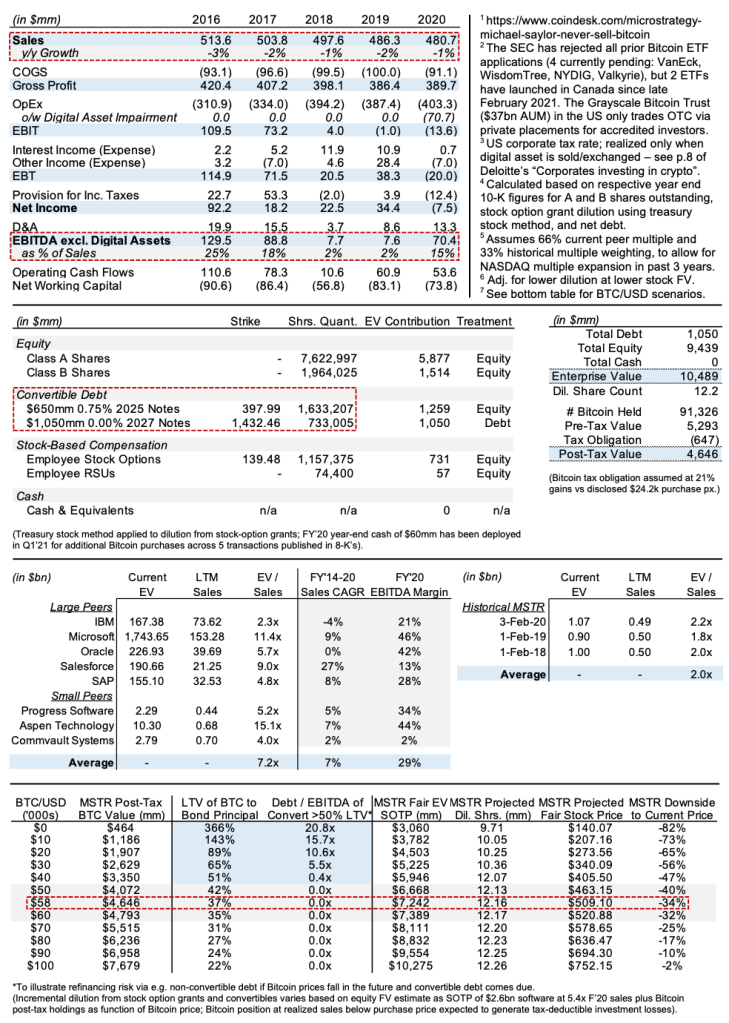

MSTR is a Virginia-based, NASDAQ-listed prepackaged enterprise software provider with $480mm in FY’20 sales. The company has also deployed substantial capital in Bitcoin, including the full $1.7bn proceeds of two recent convertible debt offerings in December ‘20 and February ‘21, and currently owns ~91k Bitcoin worth $5.3bn pre-tax. MSTR has thus emerged as a novel hybrid: a software business plus a levered Bitcoin investment fund, combined in a publicly listed equity.

Leading the charge is Michael Saylor. Saylor is Founder and CEO, as well as owner of ~72% of MSTR’s voting rights (via dual class stock). He is an outspoken advocate of cryptocurrencies, frequently commenting on various media about corporate finance paradigm shifts in a post-fiat world. And to his credit, at $3.1bn pre-tax gains, the mark-to-market PnL on his company’s Bitcoin holdings has been stellar. Additionally, Saylor proudly proclaims: “I didn’t buy it to sell it, ever”1. This maximalist position has proven appealing to investors facing ongoing difficulties to find economical access to long Bitcoin exposure via the stock market, given continued ETF regulatory roadblocks on behalf of the SEC2.

Meanwhile MSTR’s software business offers a comprehensive enterprise platform and product support, flanked by premium consulting and education services. Competitors identified in company filings include IBM, Microsoft, Oracle, Qlik, Salesforce, and SAP. However, while MSTR has a diversified customer base, a sticky product, and modest earnings/operating cash flows, it fails basic valuation criteria; MSTR is showing neither top-line growth nor margin expansion. Revenues declined consistently every year since FY’14, at a -3% CAGR. And EBITDA margins are quite volatile and averaged only 14% over the same period. Generally, it seems the software business is losing management’s focus. As a crude gauge – in MSTR’s FY’20 10-K, “Bitcoin” shows up 349 times, while “software” shows up 149 times.

The key question is whether 1+1=2.5. We must ask (a) if owning bitcoin makes the software business worth more – through brand awareness and acquisition of crypto-loyal customers – and (b) if the software business makes owning bitcoin worth more – through marginal cost of capital improvements to any debt- funded purchases due to wider collateral scope. However, the first benefit seems negligible, and the second makes the software business liable for large Bitcoin drawdowns and thus seems rather zero-sum. As a result, while MSTR proclaims it a “business strategy” to buy Bitcoin through cash when it exceeds working capital needs and through tapping capital markets, in reality it’s just a risky treasury management strategy that lacks synergies. Consequently, MSTR should not trade at a premium to its sum of the parts.

The market, however, disagrees with this assessment. At an MSTR stock price of $771, the company trades at a fully diluted EV of $10.5bn. Given a post-tax Bitcoin value of $4.6bn at $58k BTC/USD (21% tax rate on gains3), we arrive at a $5.8bn software value. However, the implied EV / FY’20 sales multiple of 12.2x screens as very rich, especially in comparison with MSTR’s multiples before it started buying Bitcoin in August ’20. In February ’20/’19/’18, MSTR prices of $149/$128/$139 implied 2.2x/1.8x/2.0x LTM sales4, respectively. Also, a selection of large and small listed peers (with much stronger revenue growth and EBITDA margins) currently trades at an average of 7.2x LTM sales. By applying a blended multiple of 5.4x to MSTR’s software business5, we arrive at a 34% overvaluation6 of MSTR’s stock price.

This mispricing is driven not only by undue optimism over MSTR’s dual strategy, but also by complexities in the capital structure. As mentioned, while the recent issuances of convertible debt may have been cost-effective in terms of pricing coupon/strike, they give bondholders priority over MSTR’s prior Bitcoin gains. If Bitcoin drops, the relevant leverage ratio will cease to be Debt / MV Digital Assets (currently 32% LTV) and shift instead to Debt / EBITDA (24.1x FY’20) – signaling the software business would have trouble servicing the principal. If Bitcoin holds up or rises, dilution is driven by both the converts and substantial stock-option grants. Finally, any progress in Bitcoin accessibility, particularly introduction of an ETF with a reasonable NAV spread, would suppress MSTR’s scarcity value as a long Bitcoin play via a listed equity.

The trade can be implemented via stock or derivatives. In stock, a short position in MSTR can be offset by a long position in Bitcoin plus a long position in IGV, the iShares Expanded Tech-Software ETF. IGV’s top four holdings – Microsoft, Salesforce, Adobe, and Oracle – account for 30% ETF weight. Position sizing per $771/-100% MSTR should ensure zero Bitcoin delta, via $327/+42% exposure (or slightly overweight, to hedge positive correlation of MSTR SOTP premium to BTC/USD), and IGV notional should reflect the Software value embedded in MSTR stock, via $182/+24% exposure. Meanwhile, options can exploit that convergence to SOTP is more likely in a large Bitcoin drawdown. By projecting MSTR as a function of low BTC/USD, e.g. $340 vs $30k7 (while holding Software steady at 5.4x), we can “match” not only maturity but also strike; buying MSTR puts and, proportionally, selling Bitcoin puts at a net credit thus offers attractive risk/reward.